FEATURED POST-

Spine Strong, Sit Long: Medical Desk Exercises for Long Sitting Hours

Spine Strong, Sit Long: Medical Desk Exercises for Long Sitting Hours Spending long hours sitting can strain your cerv...

February 27, 2022

10 TIPS-HOMES CAME CENTRE OF LIFE AFTER EPIDEMIC-OLDER SENIOR FALL

February 26, 2022

HOW TO BOOST FINANCIAL SECURITY IN 2022- RETIREMENT SAVING? CAN I TAKE-

How Much Can I Take From My Retirement Savings?

INTRODUCTION--

It's complicated, but this method can keep you from running out of money

The most difficult and important issue among those near or in retirement is “How much of my savings can I spend each year without running out of money?” Morningstar, the financial research company, has done some outstanding work recently to answer this question{2}

| ||

|

Comes to their financial planning over the next several decades isn’t just how to start saving more money, but how much each person should be able to spend on living expenses. For example, if you retire today, the cost of housing, health care, food, and entertainment, as well as your mortgage and other bills, will increase, leading to significantly fewer income years. Similarly, with an eye toward inflationary pressures, it is possible that interest rates could rise even further, making it increasingly hard for most family- and friend-to-friend investors to put aside additional cash each month. As such, what is the best way to plan for your future while maintaining enough cash on hand that you don’t run out of funds as quickly as you may want?

WITHDRAWALS PLAN FOR THE FUTURE-

5 Consequences of an Early .

You've been working hard, and now it's time to plan for the future. One of the most important steps is figuring out how much of your retirement savings you can take. That may sound easy, but does this depend on how old you are? How much money you have saved? How much interest do your investments earn? For as many questions as there are about taking a withdrawal from a retirement account, there are just as many answers. But understanding what you need to know before making any withdrawals from your retirement account will help clear up some confusion. So if you're wondering "How Much Can I Take From My Retirement Savings?" then the answer is not more than what can be replaced by other sources of income, like Social Security and pensions.

ADVISORY--PENSION PLAN-

|

| BEST RETIREMENT CALCULATOR |

William Lowther III-For nearly 20 years, he worked on equity and fixed income strategies in private institutions, including institutional asset managers like Credit Suisse. While there, his responsibilities included both investment management and advisory services, and he spent time helping corporate clients optimize capital flows by advising them about ways to achieve better outcomes through disciplined investing techniques. He also had a successful track record, having advised high net worth individuals, foundations, trust companies, and pension plans since the early 1980s, during periods when public equities were underperforming assets. He is a member of two major stock exchanges where II has served as an advisor to boards and chairpersons and serves on multiple board committees. In addition to these assignments, William is actively involved in industry groups, including working as a founding member of the Investment Managers Association/Council of Financial Regulators (IMA/CFR). He also worked extensively as a consultant to the New York Stock Exchange, leading numerous rounds of interviews and presentations to top fund managers. His last job was in 2017 as Managing Principal, Corporate Treasury of PNC and Bank National Corporation. William received a Lifetime Achievement Award from the American College of Trust and Estate Counsel

Retirement savings are classified in two ways: as a tax-deferred account or as an account that is not tax-deferred. There are different rules for these types of accounts and the amount that you can take out. This article will help you understand the difference between the two types of accounts and how they affect your ability to take money out of them.

Early retirement isn't for everyone-

Unfortunately, early retirement isn't for everyone. In fact, it isn't for most people. Just 11 per cent of today's workers plan to retire before age 60. For many of those who do take the plunge, the reality of early retirement can turn out to be far different than the fantasy. Here are a few things to consider before you decide to retire early.{1}

Initial Safe Annual Withdrawal Rate based on your stock asset allocation and time horizon Source: Morningstar | ||||

|---|---|---|---|---|

| % savings in stocks | 10 years | 20 years | 30 years | 40 years |

100 | 8.3% | 4.3% | 2.9% | 2.5% |

90 | 8.6% | 4.4% | 3.0% | 2.6% |

80 | 8.8% | 4.6% | 3.1% | 2.6% |

70 | 9.1% | 4.7% | 3.2% | 2.7% |

60 | 9.3% | 4.8% | 3.3% | 2.8% |

50 | 9.5% | 4.9% | 3.3% | 2.8% |

40 | 9.6% | 4.9% | 3.3% | 2.7% |

30 | 9.7% | 4.9% | 3.3% | 2.7% |

20 | 9.7% | 4.8% | 3.2% | 2.5% |

10 | 9.5% | 4.7% | 3.0% | 2.3% |

0 | 9.5% | 4.4% | 2.7% | 2.0% |

The table shows how much money you can withdraw from your retirement funds in the first year of retirement. The vertical axis on the left shows the percentage of your holdings that are in stocks. The horizontal axis on top is the number of years you expect to be in retirement. After the first year, you can increase your withdrawal every year by the amount of inflation.

Conclusion-

What to Do If You're Retiring With DEBT

The pandemic has changed many people’s life goals — and financial goals, too. When you have clarity regarding what is most important to you in life, your financial decisions can become surprisingly simple. without following any financial advice you better sketch your own chart considering some figure-1 service remaining 2 your standing liabilities which will be performed definitely.3- approximate interest earned 4-Medicare policy 5- family marriage.6- maintenance of the house. believe your monthly expenditure is less than your monthly income. IN ADVERSE TIME NOBODY COME TO HELP FREELY ACCEPT YOUR HARD-EARNED MONEY AND IF YOU HAVE NO SAVING OLD AGE IS VERY PAINFUL AND DEPENDABLE AND PITIABLE.

February 24, 2022

IT'S NEVER TOO LATE;GETTING OLDER WISER WORRY-FREE IN OUR GOLDEN YEARS

February 22, 2022

BELIEVE IN SAVING-DRAMATIC IMPACT ON QUALITY OF LIFE- AFTER RETIREMENT

|

| 3 Money Mistakes That Will Come |

Utmost families are spending MONEY further and further every time while also saving less and less. Still nearly every family has places where costs can be cut and pennies can be pinched-- and if those freed up finances are also used to pay down debt. The cutdown area is finance, plutocrat, budget, particular, family, credit, debt, loan, mortgage, auto, house, refinance. The major areas are followings-

1-Food is one big area--

2- Major expenditure is home--

|

| Your Old Age Security Retire Happy |

3-Transportation--

4-Choosing bank wisely--

5-Cutting credit card costs--

6-Health care--

A retirement savings crisis or not_

It isn't really an area where you can cut charges but you can save plutocrat by taking advantage of special offers and programs. For illustration, numerous employers offer a Flexible Spending Account where you can save plutocrat before levies for out-of-fund medical charges for traditional and nonprescription medicines, dental charges, and eye care.

Another major expenditure for numerous families is the cost of communication including original and long-distance phone service, cell phones, string or satellite TV, and Internet access. Review your expenditures and cut out the services you do not need. Are there better plans for your requirements?

The Internet makes it a possible moment to compare prices and product reviews while not spending a lot of time and plutocrat driving from store to store.

Over the coming, month take time to review your family charges and expenditures in each of these nine areas. Making many differences in your family's spending habits will soon make a difference in the overall ménage budget. You can raise your family's quality of life by making just many changes in your yearly budget. In older age after retirement, there are three factor major impact on life-

February 21, 2022

HOW TO GETS POSITIVE WAVES FLOWING IN MIND -AGEING GRACEFULLY

A Favorite History Time Hobby Ideas You Will Like

INTRODUCTION- |

| FUN INDOOR GAMES FOR OLD MAN |

1-Music as a favorite history time--

|

| PLAY WITH STUDENTS |

8-Beach volleyball --

|

| OUTDOOR GAMES FOR SENIOR CITIZENS |

The world is full of intriguing effects to learn and do. Do not simply sit back and watch Television. Get interested in a one-time hobbyhorse. It's good for your mind. In fact, it might indeed keep you from going senile in your old age, if you stay active in a once-time hobbyhorse. And it's a good illustration of our kiddies and grandkids. The kiddies will enjoy this once-time sport. Kiddies are naturally energetic and active, making once-time sports conditioning extremely seductive to them. These vigorous games are a good idea for everyone. This could be so, since exercise gets positive hormones flowing in your mind, putting you and everyone differently in a better mood.

IS IT POSSIBLE SET MENTAL STRENGTH LIKE SWITCH ?--AGEING

INTRODUCTION-

|

| 7 Negative Mindsets |

cognizance, mouth, hands and bases from all the corridor of the body. also, the brain is also a part of the body, so just like we use our hands when demanded, after that they need to rest. In the same way, we should also deal with our mind when we need the mind, also run it, also ask it to suppose else, also let it rest and see the studies that are arising in the mind. you can suppose of your own thinking. Don't apply power.

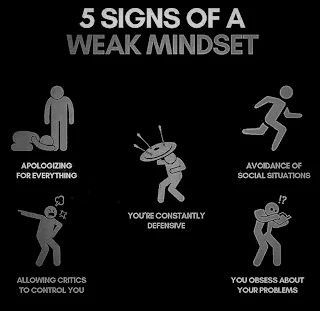

5 SIGNS OF A WEAK MINDSET-

1-APOLOGIZING FOR EVERYTHING2-YOU ARE CONSTANTLY Protective

3- AVOIDANCE OF SOCIAL SITUATION

4- ALLOWING CRITICS TO CONTROL YOU

5-YOU OBSESS ABOUT YOUR PROBLEMS

|

| older man-comfy home |

10 WAYS TO COME MENTALLY STRONGER

You can meditate in the morning or whenever you have time during the day--

1- TAKE 15 Twinkles A DAY TO SELF REFLECT 2- DO AT LEAST 1 TOUGH THING Any DAY 3- GIVE UP ONE BAD HABIT 4- DEVELOP POSITIVE SELF TALK 5-IDENTIFY CHALLENGES AND SET Pretensions 6- IDENTIFY YOUR STRENGTHS AND Sins 7-JOURNAL DAILY 8- WRITE DOWN 10 IDEAS EVERY DAY- MAKE YOUR IDEA MUSCLE 9- TAKE CARE OF YOUR PHYSICAL HEALTH 10-CREATE A HEALTHY PLAIN.

|

| 5 SIGNS OF WEAK MINDSET |

When the mind is weak, situations come problems. On the other hands When the mind is still, also that situations come in front like a challenge. But when the mind is feeling strong mind set, also circumstances come opening as a opportunity.It is not possible to shut down your mind like on/off switch.

February 15, 2022

ALSO AT RISK? DIABETES AGING+60 HAND FEET EYE KIDNEY NOW HEARING LOSS

INTRODUCTION-DIABETES- HEARING LOSS CONNECTION-

Hands, feet, eyes and kidneys — all of these body parts are at risk of nerve damage as a result of the condition with diabetes. Hearing loss is twice as common in people with diabetes than in people the same age without the disease. Diabetes can damage the blood vessels and nerves of the INEER EAR, as well as disrupt the nerve signals that carry sound input from the inner ear to the brain{1} both high and low blood sugar plays a role in causing this damage, which underscores the importance of keeping blood sugar levels{2} Some diabetes medications can also harm your hearing.

|

| Your Hearing, Diabetes and Cardiac |

10 Signs of Hearing Loss You Shouldn’t Ignore if You're More Than 65 Years Old--

Hearing loss is one of the most common chronic conditions in adults over the age of 65. It’s also one that can be prevented or treated, but many people don’t realize they have it until it's too late. There are some signs to look out for if you're concerned about your hearing, and here are 10 of them. , watching for warning signs of hearing loss and making time for yearly hearing screenings are key to protecting your ears while living with diabetes.

Common signs of hearing loss--

1. Difficulty hearing someone in a noisy environment

2. Difficulty understanding speech on the phone

3. Struggling to follow conversations

4. A feeling like there is something in your ear

5. Difficulty understanding what people are saying when they speak on TV

6. Feeling like you need to turn up the volume to hear a sound well

7. Having trouble hearing a conversation at a crowded party or restaurant

8. Trouble telling whether two words sound alike, such as "rice" and "rise"

9. Trouble following a conversation in a noisy room with more than three.

The problem with hearing loss-

Body Parts Affected By Diabetes

It's important to realize the problem with hearing loss. It's not just an issue that impacts your day-to-day life, it can also lead to serious health conditions like dementia or depression.

HOW TO MONITOR AND PROTECT-

1- Regular screenings- audiologist

2-Sharing results from your audiologist with the rest of your primary care

3-Protecting your ears

4-Monitoring blood sugar

5-Not delaying treatment

What to do if you think you have hearing loss--

|

| surprising link between diabetes |

If you think you might have hearing loss, contact your doctor or an audiologist. They will listen to what you're experiencing and discuss options with you. There are many hearing aids available on the market today that can be customized to your needs. For example, some people need to hear softer sounds while others need to focus more on speech. Your hearing aids can be adjusted for these specific needs.

A lot of people think they don't need hearing aids because they don't want to admit they're getting older. But it's important not to put off treatment because age-related hearing loss is irreversible. If you don't get treatment, the hearing problems will only get worse over time and eventually become so severe that you won't be able to perceive any sound at all. So if you suspect something is wrong with your hearing, see a doctor right away before it's too late!

|

| Age-Related Hearing Loss |

Hearing loss caused by diabetes is sensorineural, meaning it is permanent but can be treated with hearing aids. People often ignore the signs of hearing loss because they’re unaware of the problem. One way to think about it is this: if you’ve noticed

some of the signs of hearing loss, it’s time to get it checked out. Hearing loss is not something to take lightly, and while there are some things you can do on your own, it's best to consult a professional if you are more than 65 years old.